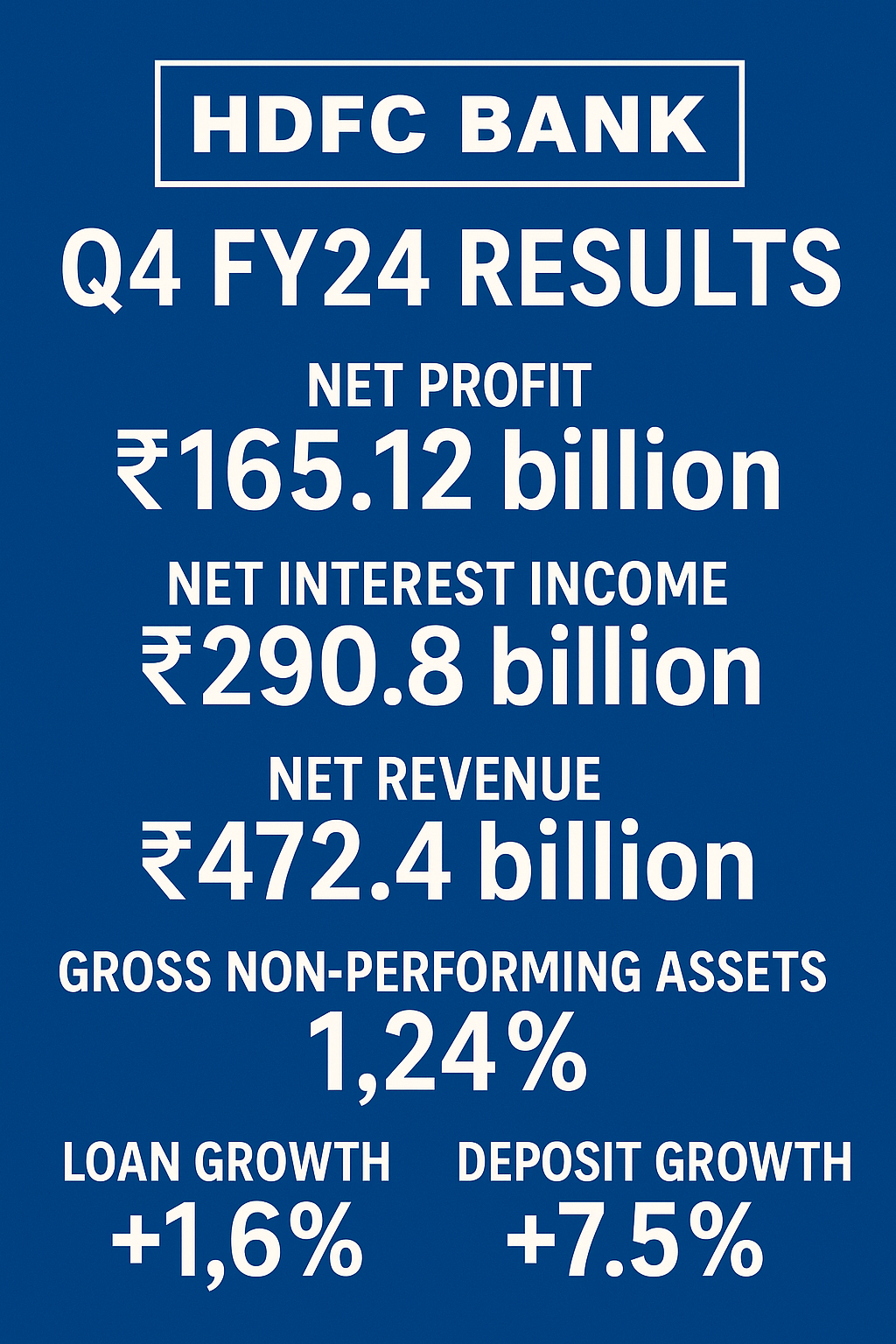

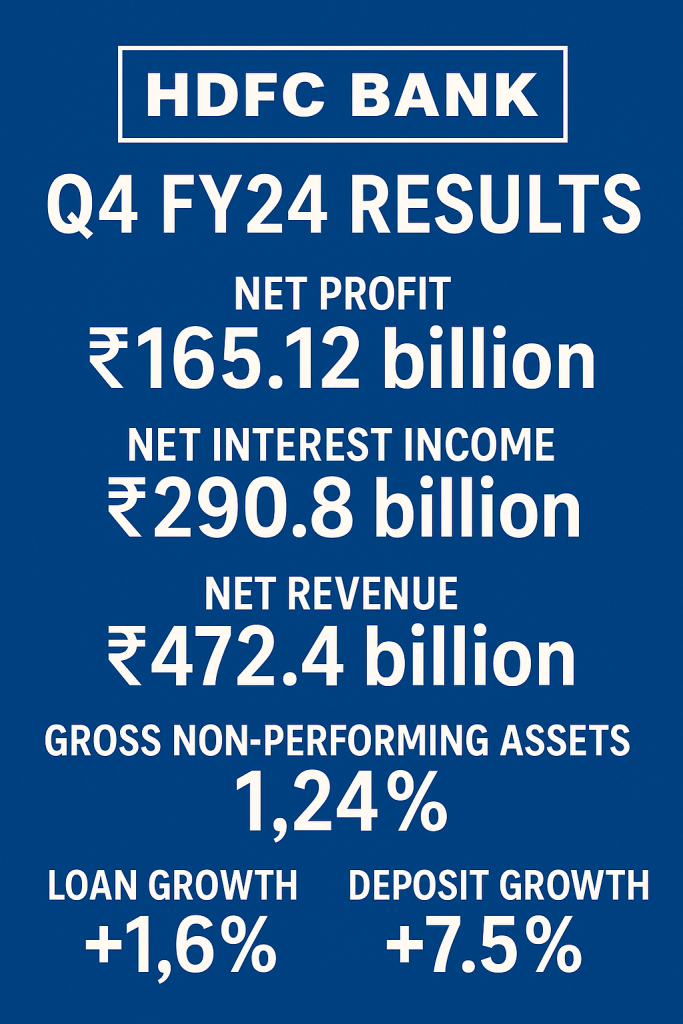

Despite surpassing revenue and deposit growth benchmarks post merger, HDFC Bank’s net profit of ₹16,512 crore paints a different picture as seen in their Q4 FY24 results. A detailed analysis on streams of NII, asset quality, financial highlights, and market projections.

HDFC Bank, India’s largest private sector lender, announced its Q4 FY24 (January – March 2024) results on April 20, 2024, showcasing strong resilience and operational stability against structural transitions after its landmark merger with HDFC Ltd. Bank’s net profit stood at ₹ 16,512 cr which was slightly below analyst expectations, but undershoot was minimal in the context of strong operational backbone and post-merger strategic progress.

In this blog, we attempt to uncover HDFC Bank’s performance in Q4 FY24 focusing on key financial metrics, growth indicators, strategic moves, and market expert commentary.

Net Profit and Revenue: Expected to be robust but aren’t.

HDFC Bank’s net profit for Q4 FY24 stood at ₹ 16,512 cr marking a marginal increase from ₹ 16,373 Cr in the last quarter, while analysts expected it to be around ₹ 17,315 crore. In the bank’s own words, they have cited dramatic increases in provisions, which this quarter have surged threefold, as the culprit.

The earnings were less than expected, however, the revenue was strong at ₹47,240 crore due to transaction profits of ₹7,340 crore from partially selling HDFC Credila Financial Services. This reinforces the bank’s capability to earn diversified income aside from the interest accrued on deposits.

Net Interest Income (NII) and Financial Margins

One of the top indicatives for a bank’s business health, Net Income from Interest (NII), grew 2.1% QOQ – “quarter on quarter” – to reach ₹29,080 crore. This growth shows balance in the loan book growth and asset yield.

The NIM (Net Interest Margin) stood at:

3.44% on total assets;

3.63% on interest – earning assets

As we can tell these numbers are consistent which indicates the bank is executing adequately on funding cost management amidst global deposit releasement and interest rates.

After the merger, Deposit Mobilization remains a focus area, especially because of the concern over reliance on borrowed funds in HDFC Ltd’s structure.

The Bank’s LCR came in at 115%, which is above the minimum threshold of 110% and below the upper limit of 120%, indicating a healthy liquidity position.

Assets Quality: GNPA Tracking modif.

HDFC Bank has realized improvement in its asset quality metrics:

Gross Non-Performing Assets (GNPA) decreased from 1.26% in Q3 to 1.24%

Net NPA (NNPA) remains at 0.33, which is a manageable level.

This slight enhancement points to active engagement in effective credit risk management alongside disciplined lending, even with the challenges resulting from the merger complex with prevailing factors.

The Bank has also made a provisioning charge of ₹13,510 crore, mainly as a counter-cyclical buffer, aimed at boosting the balance sheet’s resilience against potential credit risks.

Operating expenses increased moderately due to ongoing integration efforts and branch expansion to assist future growth.

Cost-to-Income Ratio and Operating Expenses

HDFC’s Cost to income ratio was calculated at 40.4%, showing lack of significant changes reflecting operational efficiency. This in turn indicates stabilty within the lifecycle of the firm.

HDFC Bank emerged as a financial epicenter of the country with both retail and mortgage lending market shares after merging with HDFC Ltd in July 2023.

Having a private strategical blueprint offers banks:

Large base of customers

Digital integration

Unified digital infrastructure

Rationalized branches and increased efficiency

Improved opportunities for cross selling

Scenario of an increased Profit

Nonetheless, the short term taper in profit margin because of funding position variances is mitigated over a quarter or two in the long run as deposit and interest income stabilizes alongside other metrics coming online.

Industry Analyst Commentary

Brokers reactions to the quarter four results offer a mixed reaction.

Bernstein expects the 15% increase in loan and 18 to 19% increase in deposit for FY25,

Waiting for CLSA and jefferies who maintain a sustained buy due to bank’s agile credit quality stance and reliable golden return ratios.

Goldman sachs expressed concern on the taper of profit margins alongside deployment of capital suggesting dwindling net revenue of the firm in the long run leading to net loss.

The market demonstrates adaptive and reliable outlooks on the post quarter metrics despite these factors.The enduring flexibility, which fuels the HDFC’s sustained growth

For clsas jeffries it is market optimistic about sustaining net income flexibly focuses into a net profit recovery post multi metric collapse.

Stock Market Performance

HDFC Bank shares experienced some trading volatility after the results came in, which reflected the missed profit alongside the retained investor confidence in the longer-term fundamentals. As the post-merger ecosystem settles down, the stock could be re-rated to higher levels based on improved metrics and consistent delivery against strategic plans.

Conclusion

HDFC Bank’s Q4 FY24 results disclose a bank undergoing a transformation while simultaneously exhibiting strength. The profit miss on the higher end of provisioning is offset by headroom growth in NII, deposits, and asset quality enhancing the profile of the bank, which seems, on the surface, a well-capitalized institution with considerable foresight.

HDFC Bank remains, as expected, the cornerstone of the Indian banking sector with a leading position in both scale and innovation due to the expected synergies creeping in from the merger alongside existing operational levers.

Read more: https://scopesignal.xyz/ https://dailystream.quest/